No estas registrado.

#211 13-03-12 13:57

- Fuentes H

- Miembro

- Calificacion : 6

Re: MOLYMET

el problema es que hoy es la fecha límite de dividendo y a eso se debe el alza. Pero si post dividendo confirma el alza... se pone muy atractiva

Creo que es en abril el dvvdo...

Desconectado

#212 13-03-12 14:16

- CalifornianSurfer

- Miembro

- Calificacion : 43

Re: MOLYMET

Sí me equivoqué.

Creo que el alza se debe a que China dijo que limitará sus exportacions de metales raros y Obama dijo que demandará a China por esa cláusula. Un análisis A vuelo de pajáro: Menor oferta de metales raros = escases = alzas en precio = mejores ventas y utilidades PARA MOLYMET. Ojo, moly rompe los 8500 que fueron techo sicológico.... muy bullish se ve

SU SECTOR EN EL EXTRANJERO HACE SUBIR A MOLYCORP Y RARE METALS ELEMENTS COMO + DE 4%

http://finviz.com/chart.ashx?t=AVL&ty=c&ta=1&p=d&s=l

http://finviz.com/chart.ashx?t=MCP&ty=c&ta=1&p=d&s=l

NOTICIA SOBRE OBAMA

Obama says limits on China rare-earth exports hurt hybrid cars

March 13, 2012, 12:56 PM

The U.S. moved forward with a trade complaint against China over restrictions on exports of rare-earth metals which are key components in many high-tech and alternative energy products.

The U.S. has requested talks with China at the World Trade Organization about Chinas export restrictions on certain rare earths, Obama announced in a statement Tuesday. European and Japanese trade officials joined the request.

Being able to manufacture advanced batteries and hybrid cars in America is too important for us to stand Spam and do nothing, Obama said, in a statement. We cant let that energy industry take root in some other country because they were allowed to break the rules, Obama said.

The dispute has been brewing for some time.

In recent years, China has lowered their rare earth export quotas, citing environmental protection and the need to achieve sustainable development, said analysts at Dahlman Rose & Co., in a note Tuesday. The West has claimed these restrictions have artificially inflated rare earth prices and provided Chinese manufacturers with an unfair advantage.

For now, Chinese export quotas for 2012 have been set roughly in line with 2011 quotas at approximately 31,000 metric tons, they said.

A WTO ruling earlier this year could set the precedent for a decision on rare earths, the analysts said, noting that in January, the WTO ruled against Chinese export taxes and quotas for certain industrial metals, including bauxite, zinc, yellow phosphorus and magnesium.

But it typically takes the WTO 18 months to two years to rule on trade challenges, they said.

While average rare earth oxide prices have declined Spam over 20% since the start of the year, lower prices are leading to stronger demand, the Dahlman Rose analysts said. Prices have already fallen significantly from the August 2011 peaks, and a WTO ruling could take some time. Therefore, we do not anticipate a drastic decline based on this news.

Still, with all the talk of complaints against Chinas rare earth quota limits, shares of rare earth producers have seen a significant boost on Tuesday.

Shares of Molycorp Inc. MCP +3.83% , the only rare earth oxide producer in the Western hemisphere, climbed 6.5% Tuesday. Molycorp announced last week that it plans to acquire Neo Material Technologies Inc. to gain exposure to China, which is the worlds largest rare-earth consumer.

Shares of Rare Element Resources Ltd. REE +10.33% were also up 11% and Avalon Rare Materials AVL traded 5.8% higher

http://blogs.marketwatch.com/thetell/20 … brid-cars/

"impossible Is Nothing"

Desconectado

#213 13-03-12 14:21

- Sombra

- Miembro

- Calificacion : 1

Re: MOLYMET

Dividendo

Fecha Corte: 13-04-2012

Fecha Pago: 19-04-2012

saludos

Desconectado

#214 13-03-12 16:36

- CalifornianSurfer

- Miembro

- Calificacion : 43

Desconectado

#215 13-03-12 19:50

- Pontifex

- Moderador

- Calificacion : 108

Re: MOLYMET

que complicado no entrarle, son de esas.

sl2s

Px

"LASCIATE OGNI SPERANZA, VOI CHENTRATE" Dante " La divina Comedia"

Desconectado

#216 14-03-12 19:20

- PATALARRASTRA

- Moderador

- Calificacion : 147

Re: MOLYMET

La Esperanza es, en verdad, el peor de los males, porque prolonga las torturas de los hombres.(Friedrich Wihelm Nietzschee) @patatrader

Desconectado

#217 14-03-12 21:11

- CalifornianSurfer

- Miembro

- Calificacion : 43

Re: MOLYMET

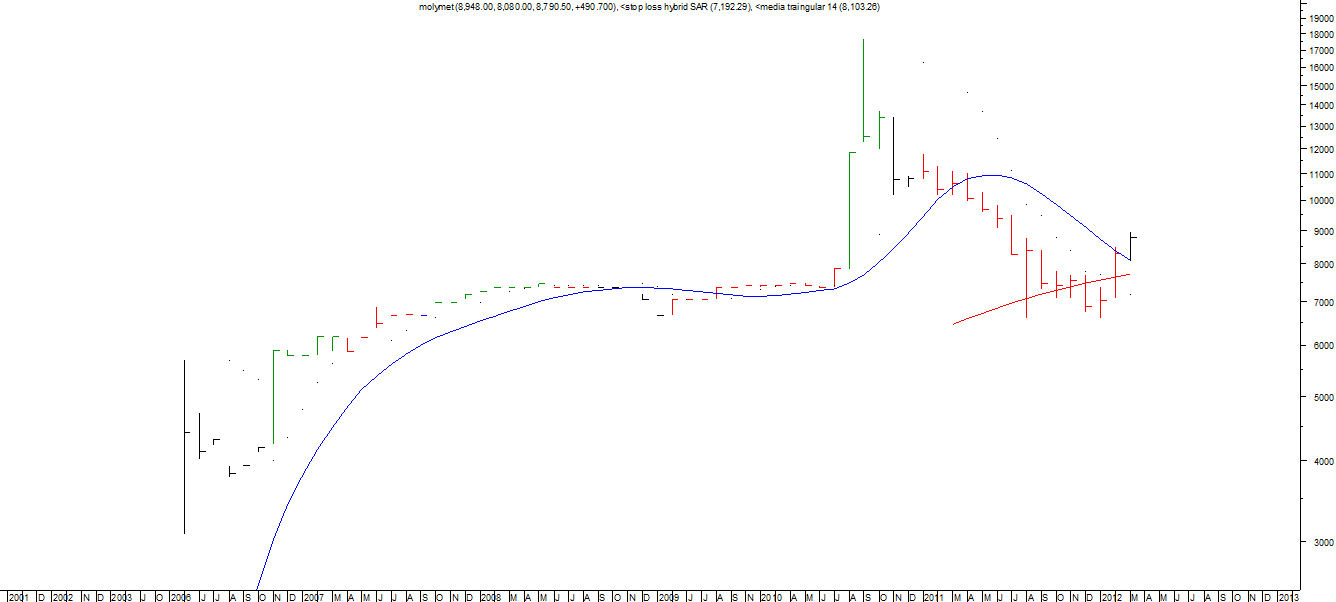

Ese gráfico está correcto???? falta el cierre de hoy??

"impossible Is Nothing"

Desconectado

#218 14-03-12 21:32

- NANOTEC

- Miembro

- Calificacion : -13

Re: MOLYMET

El gráfico está mal, pero el papel está muy bien.

Ese gráfico está correcto???? falta el cierre de hoy??

Desconectado

#219 14-03-12 22:12

- PATALARRASTRA

- Moderador

- Calificacion : 147

Re: MOLYMET

Ya lo arreglé, me pasé por alto un día de data, alto consumo de ansiolíticos...

Uploaded with ImageShack.us

La Esperanza es, en verdad, el peor de los males, porque prolonga las torturas de los hombres.(Friedrich Wihelm Nietzschee) @patatrader

Desconectado

#220 16-03-12 14:13

- Solrac

- Miembro

- Calificacion : 0

Re: MOLYMET

Qué pasó aquí.....

Desconectado

#221 18-03-12 02:46

- CalifornianSurfer

- Miembro

- Calificacion : 43

Desconectado

#222 19-03-12 15:04

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Hoy hubo cero interes por esta accion. Como si el volumen de aca se hubiera ido a Iansa (por decir una tontera).

Yo le habia entrado el viernes con un poquito en la mañana y despues me salio con esa tremenda vela roja y ahora con esta velita con nada de volumen. Busque en los patrones de velas pero no encontre ni uno que aplicara bien.

Me puse a mirar a masisa que era otra accion que venia bastante bien y que hoy anduvo corrigiendo un poco a si que me da para pensar de que la falta de interes fue simplemente darle una pausa por ir a buscar otras que andan mas resagadas, aun que masisa no tiene ese tremendo velon rojo que hizo molymet el viernes. Para dar otros ejemplos como masisa, tambien esta Soco.

Bueno veremos que sucede mañana. Si se pone fea la cosa no queda otra que salir corriendo.

Saludos,

Desconectado

#223 20-03-12 10:06

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Ahi me baje el archivo que subiste para hecharle una mirada.

Bueno hoy se ve que se esta afirmando por sobre los 8500 y eso me gusta, veremos que pasa.

Y gracias por la disposicion ![]()

Desconectado

#224 20-03-12 17:31

- CalifornianSurfer

- Miembro

- Calificacion : 43

Re: MOLYMET

Les presento un análisis muy subjetivo de una posible burbuja en metales raros. Éstos se utilizan para tecnología muy avanzada, por ejemplo para hacer equipos de energía eólica, sólar y nuclear. Hace poco China (mayor exportador global) dijo que limitaría exportaciones, entonces podemos proyectar (como teoría) que habría menor oferta y subiría el precio del molibdeno, por ende, aumentarían los ingresos de molymet y utilidades...... Igual vale la pena tenerlo presente.

Salu2

The Rare Earths Bubble Is Coming Back

http://seekingalpha.com/article/441511- … urce=yahoo

Inflationary monetary policy is the story of the world these days, as it has been for the past 11+ years -- or for the past 40 years, if you take a broader look at money supply. But the past 11 years is when money supply has really gone out of control, fueling a new age of bubbles: dot com, housing, commodities, cleantech, rare earths, uranium, dot com again, and likely more to come.

For the astute investor alert to what is happening and experienced enough to avoid getting caught up in the emotions of volatility, this constitutes an enormous opportunity to invest in bubble after bubble in a short amount of time.

Thus far in 2012, it seems as though rare earths may be gearing up for another phase of rapid appreciation, as many of the stocks in the sector are up well over 20% thus far in the year. Fundamentally, the market is being driven Spam a strong supply/demand imbalance, as alternative energy sources such as solar, wind, and nuclear are particularly dependent upon rare earths -- and their usage is only growing as oil becomes increasingly expensive and scarce.

This is the kernel of truth that can attract an irrational bubble enabled Spam aggressive inflationary monetary policy. Moreover, China is capping exports of rare earths, a move deemed significant enough that the US, along with Japan and the European Union, are filing a complaint with the World Trade Organization regarding China's policies. The chart below shows how some rare earth stocks -- a rather small sector -- have fared this year:

Here's a quick look at the companies in the chart above, and my thoughts on them:

Quest Rare Minerals (QRM). This is the only rare earths company thus far that I've invested in, taking my first position in December of last year. I took this position after attending the San Francisco Hard Assets Conference and meeting with the staff of QRM; I was impressed with them, as they struck me as smart people worth investing in. I'm a people person first; all of the stocks that I'm most heavily invested in -- Tanzanian Royalty (TRX), McEwen Mining (MUX), and Uranium Energy Corporation (UEC) -- are because of their management.

I was also swayed to invest in QRM because an investment analyst I admire deeply (who prefers to not be named) and who is much, much more familiar with the science of rare earths than I am spoke very favorably of QRM. I also am more interested in investing in heavy rare earths rather than light ones, and QRM satisfies that desire. QRM's market cap is currently just over $173 million.

Molycorp (MCP). Molycorp was the poster child of the rare earths bubble in 2010 and 2011, and it could be regarded as the safest way to play rare earths this time around as well: the firm has positive earnings, a P/E ratio of around 23, and a market cap of 2.42 billion -- making it nearly 10X or more the size of the other companies included in this list. The company is also taking steps to become more vertically integrated via acquisitions. Because of the complexity in extracting rare earths and integrating them into products, vertical integration can be especially beneficial, and thus I'm inclined to view this strategy favorably.

Avalon Rare Metals (AVL). Another heavy rare earths explorer, Avalon has over $60 million in current assets and no long-term debt. According to its latest investor presentation, Avalon should enter production Spam 2015. I think this will put it ahead of QRM, a fellow Canadian rare earth miner, although I like QRM's mining resource better. Avalon currently has a market cap of just over $287 million.

Rare Element Resources (REE). REE has the notable distinction of focusing on rare earths AND gold. The stock did manage to trade above $16 during last year's rare earth bubble; it's currently trading at $6.12. The company has begun testing separation of rare earths that it has mined from its project in Wyoming, USA. Separation is a larger challenge with rare earths, and how the company fares here will determine its economic potential as well as its potential customers. The stock is up over 88% on the year, which makes it the best performer of the ones listed here Spam a fairly wide margin. Of course, I'm usually reluctant to buy stocks that have had such sharp moves up, and that applies here as well; I'll need a particularly sharp sell-off before I can consider jumping on board. REE's market cap is currently just over $270 million.

Tasman Metals (TAS). Tasman is the smallest of the stocks listed here, with a market cap of just over $143 million -- and this is after appreciating nearly 60% on the year, second amongst the companies on this list. The company is focused on projects in Scandanavian countries, which may provide investors with a unique opportunity to secure some jurisdictional diversification. Production is currently targeted to start in 2016. This company is a little too small for the way I personally want to invest in rare earths, but if a sharp enough sell off occurs, I could find it worth re-visiting.

Ultimately I find all the companies here worth monitoring and potentially investing in, and I've added them to my watchlist accordingly. Because I'm a bit out of my comfort zone when it comes to rare earths -- my focus is much more on gold and uranium stocks, as my articles on SeekingAlpha can attest -- I don't think I'll be investing too heavily in this sector, and will have a strong preference towards meeting management prior to investing.

I'll certainly be keeping an eye out for these companies at the upcoming hard asset conferences I plan to attend in New York, Chicago, and San Francisco later in 2012. I do plan on holding on to my position in QRM for a while -- until either I believe the bull in rare earths has come to an end or if price appreciates too quickly and is at risk of collapsing.

"impossible Is Nothing"

Desconectado

#225 20-03-12 17:45

- CalifornianSurfer

- Miembro

- Calificacion : 43

Re: MOLYMET

"Rare Earth demand to outstrip supply Spam over 30,000 tonnes in 2012"

http://www.commodityonline.com/news/rar … 45719.html

Spam Anthony David

In December 2011, the US Department of Energy (DoE) released the 2011 Critical Materials Strategy, a report that examines the role of materials such as rare earth metals in the clean energy economy. The report cautions that the US runs the risk of facing disruptions in its short-term rare earth supply chain until 2015 at least. Shortage of five critical rare earth mineralsdysprosium, europium, neodymium, terbium and yttriumcould create expensive interruptions in the production of electric vehicles, wind turbines and energy-efficient lighting.

In a statement, the DOE said, The report found that several clean energy technologies use materials at risk of supply disruptions in the short term, with risks generally decreasing in the medium and long terms. Supply challenges for five rare earth metals may affect clean energy technology deployment in the years ahead.

Prices of many of the 16 materials analyzed have been far from stable over the last 12 months and some have in fact seen ten-fold price rises. The pressure on supplies would be further heightened Spam laws that demand that incandescent light bulbs be phased out.

The 2010 report raised similar fears when China announced its decision to reduce its rare earth export quota. In its wake, the DOE developed the nations first critical materials research and development plan. The result is a $20-million amount in the 2012 spending bill towards advancing projects that develop alternate materials, diversify supplies, develop more efficient deployment of rare metals and enable recycling and reuse.

The report recommends that the US begin development of rare earth extraction, processing and manufacturing capabilities and also collaborate with Europe and Japan in attempts to reduce global scarcity.

PricewaterhouseCoopers (PwC) has also sounded an alarm about the possible supply shortage. The PwC report stated, Demand for rare earth metals is currently expected to outstrip supply Spam 30,00050,000 tons in 2012. This shortage is likely to result in a decline in production rate of devices and products such as mobile-phones, TVs, military equipment and wind turbines that require rare earth metal made components.

"impossible Is Nothing"

Desconectado

#226 22-03-12 06:40

- Aranuiz

- Miembro

- Calificacion : 0

Re: MOLYMET

Amigos:

Ayer marco en el expert advisor (velas japonesas) del meta: tres velas blancas y un rising window, alcista. veremos como se desarrolla el mercado.

saludos

Less is more

Desconectado

#227 24-03-12 04:17

- administrador

- Administrador

- Calificacion : 126

Desconectado

#228 24-03-12 07:13

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Se ve bien, me da la impresion de que su primera resistencia podria estar cerca de los 10.000.

Hay que aguantarla nomas y ver como sigue desarrollandose.

Desconectado

#229 24-03-12 10:20

- sixfingers

- Expulsado

- Calificacion : 2

Re: MOLYMET

la sigo esta accion pero me da miedo entrar...he querido entrar desde hace ya 3 semanas y me arrepiento a ultima hora...es normal ? ![]()

Desconectado

#230 24-03-12 11:03

- Curious George

- Miembro

- Calificacion : 86

Re: MOLYMET

Se ve como una linda señal para MP.

The trend is your friend except at the end when it bends (Ed Seykota)

Desconectado

#231 10-04-12 09:07

- Solrac

- Miembro

- Calificacion : 0

Re: MOLYMET

¿La siguen viendo bien a Moly? Cómo que se estancó...

Desconectado

#232 12-04-12 12:06

- Solrac

- Miembro

- Calificacion : 0

Re: MOLYMET

Sonamos parece...

Desconectado

#233 12-04-12 12:22

- Andronet

- Miembro

- Calificacion : 49

Re: MOLYMET

Acuérdate del efecto Diviedendo, que mañana cierra...

Sabiduría para escuchar al mercado, fortaleza para enfrentar sus vaivenes, y humildad para aceptar sus reglas y condiciones...

Desconectado

#234 18-04-12 11:03

- Solrac

- Miembro

- Calificacion : 0

Re: MOLYMET

Pregunta, ¿ya debería haber pasado este efecto?

Acuérdate del efecto Diviedendo, que mañana cierra...

Desconectado

#235 20-04-12 09:41

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Alguien podria subir un grafico corregido por dividendo de Molymet porfavor.

Desconectado

#236 20-04-12 11:11

- NAX

- Miembro

- Calificacion : 49

Re: MOLYMET

Desconectado

#237 24-04-12 06:51

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Gracias por el grafico Nax.

Sorry pero no me habia vuelto a meter al foro ![]()

Desconectado

#238 04-06-12 22:02

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Alguien sabe que paso con esta. Todo el IPSA bajando y esta subiendo 1,51%?????????

Desconectado

#239 05-06-12 21:39

- turok3

- Miembro

- Calificacion : 7

Re: MOLYMET

Ok gracias Sl2.

Desconectado

#240 06-06-12 13:19

- Andronet

- Miembro

- Calificacion : 49

Re: MOLYMET

Ojo con Molymet... Se encuentra justo justo en un punto de inflexión interesante a mi juicio.

Recordar que cuando a esta le da por escaparse, lo hace bastante rápido.

Yo la tengo entre ceja y ceja... Veremos qué pasa, pero me tinca... ¿?

Sabiduría para escuchar al mercado, fortaleza para enfrentar sus vaivenes, y humildad para aceptar sus reglas y condiciones...

Desconectado